Madrid’s skyline changed dramatically a decade ago, and new activity could alter it once again.

“A forest of cranes” is how Bloomberg describes the Madrid skyline, and while the Spanish capital looks nothing like Dubai’s crane-dappled visage of a decade ago, the burst of building work in and around the city is noteworthy…

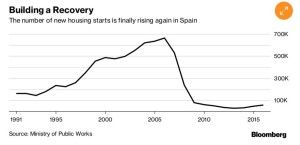

The good times for Spain’s construction sector are back. The number of new housing starts in 2013 reached a nadir, plunging 96% from the 2006 peak. At that time, few could have predicted that in the space of just four short years confidence and cash would be pumping through the industry once more.

Data from the Ministry of Public Works forecasts that the building industry – which includes the construction of new homes and offices – will grow 4% a year through to 2020, with Madrid alone expecting a 5% increase.

And it is not just the Spanish capital that is reaping the benefits of a stable and attractive real estate industry. Across the country, activity at building sites is up, with data compiled by Bloomberg showing a slight, but steady, uptick in construction.

Activity is mirroring Spain’s economy, which is on course to grow by more than 3% for the third year in a row. “The data shows a positive trend as it implies that projects quickly replace each other and therefore activity is constant,” said CBRE research director Lola Martínez. “We are recovering lost time.”

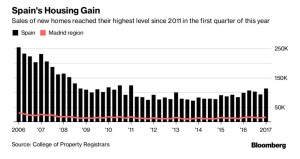

Further data from Spain’s College of Property Registrars has shown that sales of newly built homes in Catalonia and Madrid have increased 10% in the first quarter of the year, which almost matches the growth in resale properties. The two sectors’ fortunes are interlinked, although new build activity usually follows where resales first tread – a trend particularly true for the Costa del Sol, which has seen new build activity pick up significantly over the past 18 months.

Felix Lores, an economist at BBVA Research, believes that Spain has learned its lessons from the previous property boom and this time around is anchoring its recovery on a more sustainable model of consumption and exports rather than short-term credit bubbles.

“This is an important difference from the past,” Lores told Bloomberg. “We expect an annual increase of more than 6% for new home construction for 2017 and 2018. Usually a surge of the construction activity preceded an expansion of GDP, which was relying on this sector – now it’s the other way around.”

en

en

Vlaams-Nederlands

Vlaams-Nederlands

0 Comments

Leave a Comment

DISCLAIMER

The opinions and comments expressed by contributors to this Blog are theirs alone and do not necessarily reflect the views of VIVA Homes Under the Sun Ltd, any of its associated companies, or employees; nor is VIVA to be held responsible or accountable for the accuracy of any of the information supplied.

Have you got something to say?