The Law in Spain: Explaining the Catastral Value

The “valor catastral” of a property in Spain is an important estimate of its capital value. The catastral system is unlike the land registry – which records legal ownership of the property – in that it is used to calculate the volume and amount of property taxes due on each property.

To find out the catastral value of a property, simply check the amount listed on the IBI invoice or visit the catastral office, which should be located in your local town hall. It is worth noting, though, that the authorities will only permit individuals or companies with a registered interest in the ownership of the property in question to see its catastral value, which means that you cannot check the catastral value of a neighbouring property. This can be problematic, as will be explained below.

How the Catastral is Calculated

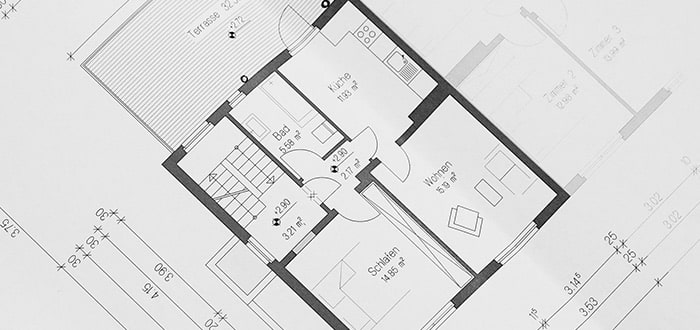

The catastral value is drawn up by independent government employees based on a strict and rather complex set of valuation guidelines. This is in order to guarantee consistency across the board but all valuers rely, initially, on a description of the property and its use. They obtain this information via personal observations, licence applications and studies of aerial photos.

Factors that influence a property's catastral value include its location, its age and build quality, its potential performance as an asset, any renovations undertaken and the associated costs of the labour.

The catastral can be one of the most reliable sources of information to settle boundary disputes because of the accuracy of its historical records and estimates of its registered dimensions. However, later upgrades and extensions can usurp the catastral, so it’s not always 100% accurate.

You could also be interested in properties for sale on the Costa del Sol

Variations in Property Descriptions

Since the details used in creating both the “nota simple ” and the “valor catastral” are obtained via different means, occasional variations in the property descriptions can occur. The most frequent discrepancy between the two tends to stem from the fact that the land registry records are compiled at the point of construction, so the property’s dimensions are declared rather than guaranteed: i.e. it is the blueprints that are recorded, rather than physical, measured dimensions, and any changes thereafter are not noted.

Once the property’s size and use (residential, agricultural, etc.) are determined, a rate per square metre is then applied to it. This rate works as an estimate of the property’s sale value, and is calculated from the remaining property information and actual registered sales of similar properties.

Neighbourhood Values

This information is reviewed every few years to ensure that it remains comparative to the market and neighbouring properties. It is conducted on a municipality by municipality basis, and thus all neighbouring properties are valued in a similar manner.

As you might expect, this approach can have its drawbacks, leading the catastral value to have no real or tangible relation to the real, current value of the property and the land. The influence of neighbouring properties' catastral values is, therefore, incredibly important.

Capital Gains Calculation

Consistency and accuracy is essential in order for every property to be subjected to the same standards for calculation. One bad apple can skew the bushel, as it were. But it is the multiplier effect of the tax authorities and politicians’ calculations that has a more dramatic influence on how much monetary value a property has.

The catastral value will be used for calculating capital gain on a property when it is sold, and also for the amount of IBI (or local property tax) that an owner has to pay each year.

Option to Appeal "Valor"

If you feel that the catastral value of your property or the property you are interested in buying is inaccurate, you can appeal, but only at the time of revaluation.

You only have a short window in which to do this, and it can be an incredibly complex procedure involving more expense, not less. So only appeal if you are convinced that the catastral value is prohibitively inaccurate.

Remember...

When purchasing a property it is imperative to inspect both the land registry and the catastral records in order to check for any errors, and to ensure that they are recorded and rectified. If not, it is you, as the buyer, who will have to bear the cost of obtaining licences, paying fines or undertaking rectifying work in order to settle any inaccuracy. A good solicitor should be able to assist you professionally and diligently during this process, but often you will need to employ a recognised chartered surveyor to compare the size and use of the actual property against the recorded descriptions on the nota simple and catastral records.

PLEASE NOTE: Every effort was made to check the accuracy of the information contained within our “Legal Advice” articles at the time of writing, but it may have been superseded over time. VIVA cannot accept responsibility for any errors or omissions, nor for the authenticity of any claims or statements made by third parties. We therefore strongly recommend that readers of these articles make their own thorough checks before entering into any kind of transaction. Prices and figures were correct at the time of publication but may now vary due to circumstances beyond our control. The views and opinions of editorial contributors do not necessarily reflect those of VIVA.

Latest update (9th January 2019)

If you want to keep up to date with the latest in Spanish legislation regarding the catastral value, read the following VIVA Blog article:

Legal advice in Spain: Important changes to Valor Catastral in 2019

Would you like to find the property that's perfect for you?

en

en

Vlaams-Nederlands

Vlaams-Nederlands